The Evolution of UK Betting Shops: From Illicit Beginnings to Modern Hubs

The opening of betting shops in the United Kingdom on May 1, 1961, marked a defining moment in British gambling history. Triggered by the Betting and Gaming Act of 1960, this seismic legal shift transformed UK betting, propelling it from the shadows of the underground scene into the public domain. Over the subsequent decades, betting shops evolved through regulatory changes, technological innovation, and shifting cultural attitudes to become a prominent feature in British society.

The Rapid Rise of Legal Betting Shops

On the very first day the new laws took effect, hundreds of licensed betting premises emerged across the country. By the end of the first six months, the number of active shops had climbed to around 10,000, with a remarkable pace of 100 new locations opening weekly. This explosive growth dramatically altered the gambling landscape, providing a safer, regulated alternative to the illegal betting networks that previously dominated the scene.

Licenses were overseen by the Racecourse Betting Control Board, granting bookmakers the right to offer "tote odds"-a system where the total amount wagered was divided among those who bet on the winning outcome. The government's intention was clear: eliminate street-based gambling, end the criminal practice of using runners to collect debts, and bring all wagering into a transparent environment.

Before this legislation, individuals wanting to place off-course bets could only do so by setting up credit accounts with bookmakers and placing wagers over the phone-a system that excluded many and fostered illicit activity. The new act ushered in accessibility and accountability, reshaping public perception of betting overnight.

From Stigma to Social Acceptance

The legalization of betting shops signaled a major cultural transformation. No longer considered a shady back-alley pursuit, wagering became a more mainstream activity. Betting shops offered a safe space for fans to engage in gambling without fearing the criminal associations of street betting.

Early regulations still reflected lingering suspicion: premises were required to keep their windows shielded, and advertising was prohibited. Despite this, the openness and regulation drew increasing numbers of people to wagering as a form of entertainment.

Industry pioneers like Ladbrokes and William Hill set the pace, rapidly acquiring smaller shops such as Fred Parkinson, JJ Simonds, and Ken Munden. Their appeal to the working class and aggressive expansion would shape the next 50 years of UK betting culture.

Modernization and Diversification in the Betting Industry

For decades, the appearance and ambiance of betting shops hardly changed. That all shifted in 1986, when updated gaming laws allowed significant improvements to shop environments. Owners could now provide seating, repaint interiors, offer refreshments, and-most significantly-install televisions. These changes ended the “dark and dingy” reputation and made shops more inviting to the public.

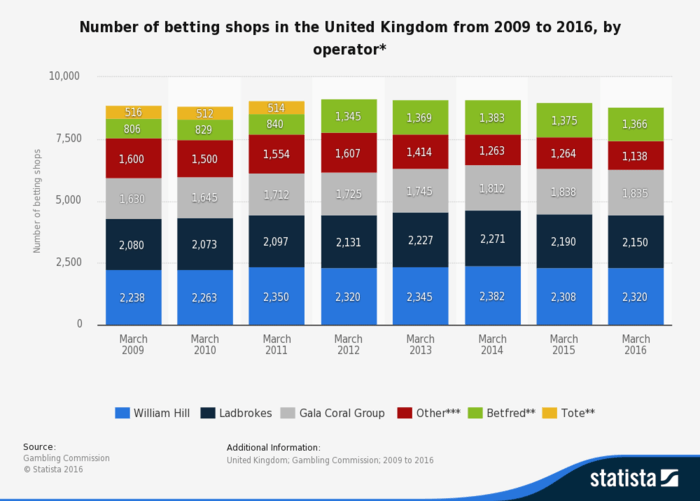

The industry also consolidated further, with four brands-William Hill, Ladbrokes, Coral, and Mecca-dominating the market. This period saw bookmaking giants campaign for the removal of a 10% tax on winnings, which was finally abolished in 2002 following years of lobbying. This change made betting more attractive, while the UK's approach set a new benchmark as other countries kept such taxes in place.

Football’s Influence: The Premier League Effect

The formation of the Premier League in 1992 had a revolutionary impact, not only transforming football through lucrative TV rights but also supercharging the sports betting market. At first, only UK-based punters could wager on Premier League games and only through multipliers of three or more matches. These restrictions were soon eased, paving the way for single-match betting and an explosion of interest.

Fan dedication to football fueled demand for more detailed betting options-bets on corners, yellow cards, minute of the next goal, and more became standard. The launch of online betting expanded this even further, and in-venue shops soon matched the breadth and speed of markets available online.

In-play betting and cash out features added additional excitement for customers, bridging the experience between online and brick-and-mortar wagering.

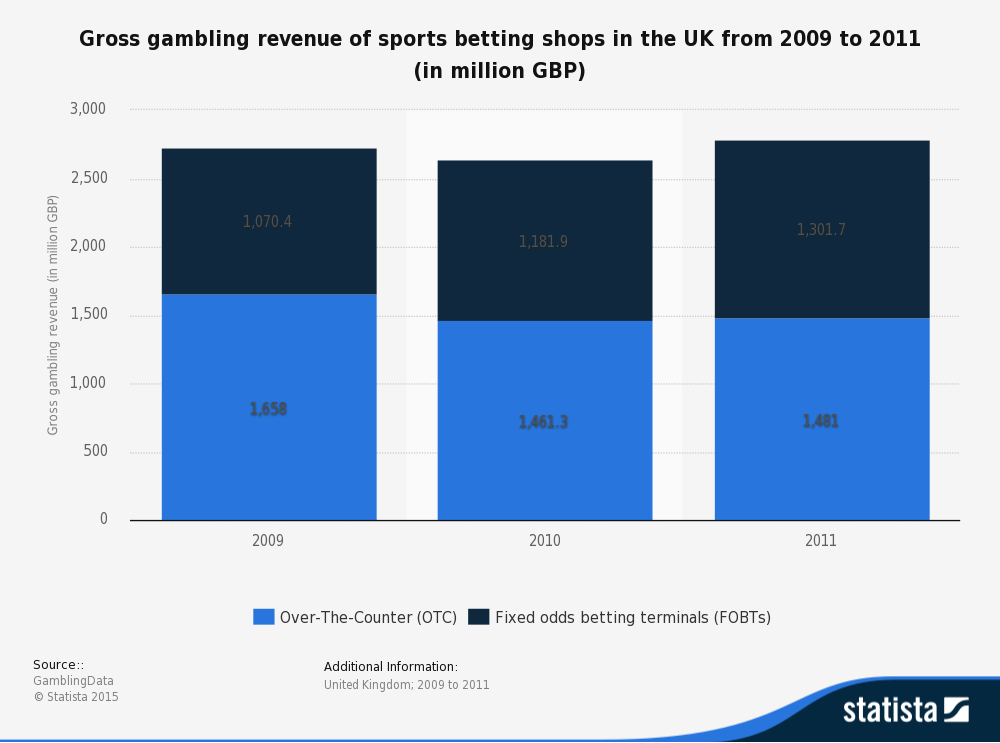

The Rise-and Controversy-of Electronic Betting Terminals

With the introduction of fixed-odds betting terminals (FOBTs) in 2001, UK betting shops entered a new, technology-driven era. These machines offered quick-fire slot and roulette games, with minimum bets set at £1 and a maximum single win capped at £500. They quickly became an essential revenue stream for shops.

But the speed and accessibility of FOBTs sparked concerns regarding addiction and their societal impact, with critics dubbing them the "crack cocaine of gambling." There were also claims of potential money-laundering, as individuals could deposit cash, make low-risk bets, and retrieve winnings as vouchers for cash payout.

Mounting pressure led to voluntary industry action in 2014, when the Association of British Bookmakers introduced options allowing players to set personal spending and time limits on these machines in an attempt to curb negative effects.

The Shift to Online and International Operations

The dawn of the 21st century saw a digital transformation as bookmakers launched online platforms, allowing punters to wager remotely. This created a significant shift in business models, driving major operators such as Victor Chandler to move operations offshore to Gibraltar, making bets tax-free for players. This prompted the UK government to rethink gambling taxation, leading to the 2014 Gambling (Licensing and Advertising) Bill. Under this law, taxation changed from a 'place of supply' to a 'point of consumption' basis. Now, all operators serving UK customers had to pay UK taxes regardless of where they were based.

These legal changes contributed to consolidation in the industry, with larger brands merging to remain competitive and profitable under the new regime. For instance, Paddy Power and Betfair combined forces, while the proposed Ladbrokes-Coral merger was contingent on divesting some of their retail shops. Data highlighted a trend: the value of individual betting shops was falling, reflecting a more challenging market.

- William Hill's 2005 acquisition of Stanley shops cost £807,000 per location

- In contrast, planned acquisitions in recent years valued shops at £277,000 each, a sharp decrease

Adapting to Threats: The Uncertain Future for High Street Betting

The internet, smartphones, and increasingly strict regulations have all contributed to a dramatic shift in the betting ecosystem. Land-based shops are under tremendous pressure to modernize and compete, not just with each other but with online and mobile betting services that now dominate the gambling market.

Betting shops are now taking cues from modern casinos by prioritizing the customer experience-introducing more comfortable spaces, advanced technology, and tailored services to entice visitors. Still, the industry faces a stark reality: shop numbers have been decreasing steadily, with the volume of UK betting shops declining by 43% since 1970.

Today, approximately 9,000 licensed betting shops remain across Britain, but intensified competition from digital betting continues to threaten their presence. To survive, physical venues will need to innovate, modernize, and reinvent their appeal to new generations of gamblers. The next chapter for UK betting shops is still being written, and their future will depend on their ability to adapt in an ever-changing landscape.