Gambling vs. Investing: How to Spot the Differences and Identify Your Approach

Understanding the Fine Line Between Investing and Gambling

The modern financial landscape is evolving, with trends like meme stocks, cryptocurrencies, and online trading platforms increasingly blurring the boundaries between investing and gambling. With such overlap, it’s more important than ever to know exactly what sets one apart from the other and how to recognize which you’re practicing.

Key distinctions include:

– Investments are made with reasonable expectations of returns over time.

– Gambling is typically random and short-term, often hinging purely on chance.

– Investment allows for research and informed risk management, whereas gambling usually does not.

– In investments, all parties can potentially benefit; gambling is often strictly win-or-lose.

Defining Investing and Gambling: What’s the Core Difference?

What It Means to Invest

Investing involves allocating money or resources with the intention of earning returns in the future. Whether you purchase real estate, stocks, or bonds, the main goal is future appreciation in value or the generation of steady income streams. Despite the market’s daily fluctuations, historical data consistently shows that broad categories like the housing market and stock indices tend to rise over time.

By diversifying your portfolio, carefully researching opportunities, and limiting fees, investors place themselves in a position to grow their wealth in line with the overarching principle of expecting future gains.

How Gambling Differs

Gambling is generally defined as staking something of value on an event or game whose outcome is random, in hopes of winning something in return. Unlike investing, gambling doesn’t provide any expectation that value will rise over time; in fact, the odds are inherently stacked against the player due to the house edge or the zero-sum nature of the bets. When gambling, the longer you play, the more likely you are to lose.

When Does Investing Start Looking Like Gambling?

In a time when digital platforms and hype-fueled markets are on the rise, it can be tricky to know whether certain actions qualify as investment or gambling. For example, buying cryptocurrencies like Dogecoin, which lack underlying value, can closely resemble speculating or gambling rather than classic investing. Similarly, day trading or splurging on options, previously the domain of seasoned professionals, has become common among younger, less experienced individuals through platforms like Robinhood.

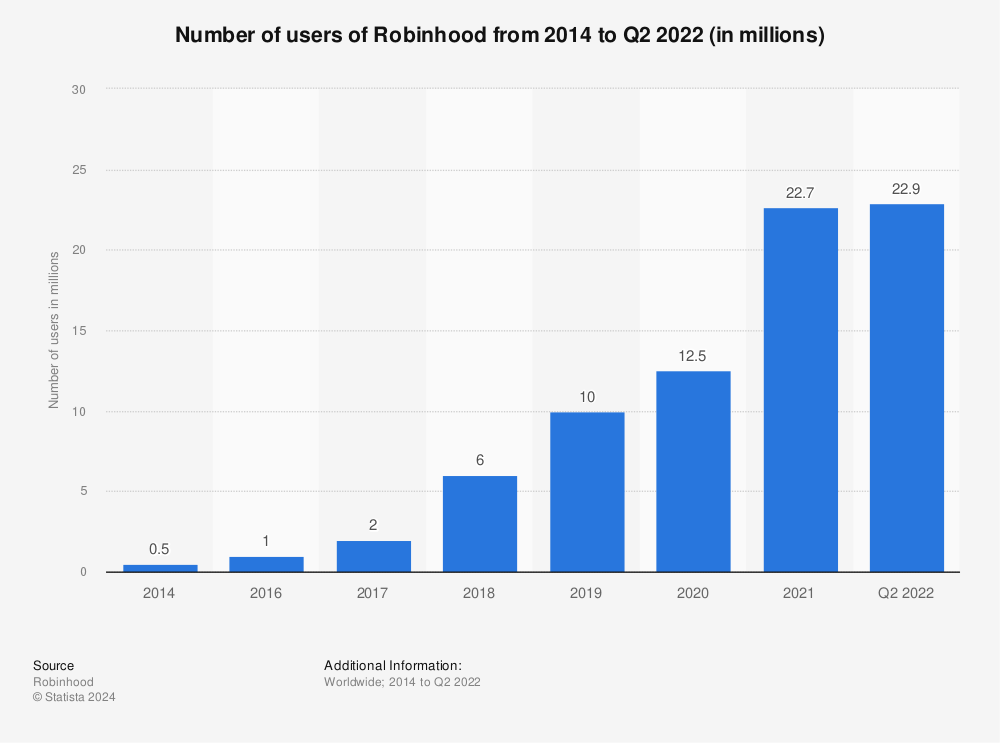

Robinhood, a commission-free investment app, grew from 500,000 users in 2014 to over 23 million in 2024. The rise of meme stocks and viral cryptocurrencies created paths for some individuals to accumulate large fortunes unexpectedly. Yet, these instances often hinge on chance rather than research or analysis, emphasizing risk over informed predictions.

To distinguish an investment from a gamble, consider the presence of risk management and the time horizon. Investors typically plan for the long term, while gamblers chase quick rewards—often to their detriment.

Evaluating Risk: The Playbook for Investing vs. Gambling

Strategies to Research Risk

One of the clearest ways to separate investing from gambling is by how risks are evaluated and managed. In traditional investing, prospective buyers look at historical data, company fundamentals, market trends, and professional analysis before committing funds. These steps are rarely, if ever, taken in casino gambling or speculative betting on unpredictable assets.

For instance, evaluating a new cryptocurrency might involve dissecting its user base or comparing it to historical pump-and-dump schemes—most of which end up favoring only early insiders at the expense of the majority. Knowledge and due diligence are what turn an uncertain bet into a probable investment.

Controlling Risk After Committing

Investment typically provides ongoing ways to manage or alter risk. As an investor, you can monitor, adjust, or sell assets as market conditions shift. By contrast, once a sports wager or roulette bet is placed, you have little or no control over the outcome or your exposure to loss.

Potential Returns: Which Approach Offers Better Long-Term Rewards?

Examining historical returns clarifies which path holds more promise for building lasting wealth. The S&P 500 index, for example, has delivered average annual returns above 12% over the past decade. Compounded over time, this type of performance can double an investor’s initial capital within seven years. Short-term losses are possible, even likely, on individual picks, but broadly diversified portfolios tend to yield positive results over longer periods.

Alternatively, a lucky casino bet can double your stake in one spin, but the odds work against you. On American roulette wheels, the house edge means an average loss of 5.27% per spin—equivalent to gradually draining your bankroll the longer you play.

However, there are rare exceptions in gambling where skill overcomes the odds. Well-coordinated blackjack teams, for example, can achieve consistent profits with advanced strategies, but this requires extensive training, capital, and discipline—qualities more akin to professional investing than casual gambling.

Who Wins: Considering the Broader Impact of Each Approach

One fundamental difference is seen in how profits are distributed. Investments are often structured so that all involved parties can benefit. When you buy government bonds, you provide needed funding to public projects and earn interest in return. In commodity futures trading, both buyer and seller can lock in beneficial prices.

Gambling, in contrast, is inherently a competition where one side’s gain is the other’s loss. The zero-sum format means not everyone benefits, and this dynamic, coupled with the potential for harm, is a primary reason why gambling has faced more legal and social restrictions compared to investing, which is often promoted as a tool for economic growth and wealth generation.

When Day Trading Becomes a Compulsion

The thrill of beating the market or outsmarting the casino can lead to addictive behaviors. Day trading, with its rapid rewards and losses, shares many attributes with high-stakes gambling. Chasing profits or attempting to recoup “losses” can lead individuals away from sound investment principles and into potentially destructive patterns.

Research highlights the dangers—when excessive focus on trading or wagering takes hold, everyday responsibilities can suffer, risking both financial and personal well-being.

Conclusion: Making Smart Choices Between Investment and Gambling

In the ever-evolving world of finance and wagering, distinguishing between a strategic investment and a speculative gamble is more complex than ever. Still, you can draw a clear boundary by:

– Expecting fair, long-term rewards.

– Using knowledge to put risk in your favor.

– Ensuring all parties can benefit, not just one winner and one loser.

– Conducting thorough research before committing your funds.

Even sound investments entail risk, so always perform due diligence and be aware of potential dangers on both paths. For additional guidance on identifying risky ventures, see resources about investment scams.