Understanding Global Gambling Taxes: How Rates Differ Worldwide

Gambling taxes significantly impact both players and casino operators, with rates varying greatly depending on the country and its regulatory approach. While many gamblers may begrudge paying tax on their winnings, it's often the casinos themselves that face hefty taxes on their earnings. Most governments tap into the gambling industry primarily through Gross Gaming Revenue (GGR)-the difference between money wagered and player payouts-with tax rates fluctuating as legislators aim to strike a balance between maximizing revenue and maintaining a healthy gambling sector.

This article explores the world's highest and lowest gambling tax rates, details the structure of these taxes in major markets, and assesses how recent global events, especially the COVID-19 pandemic, could influence future taxation policies.

The Highest And Lowest Gambling Taxes Around The World

Countries with the Heaviest Gambling Taxation

Some jurisdictions choose to levy substantial taxes on casinos and gambling establishments, allowing governments to reap significant financial rewards. Here are the leading nations when it comes to top-tier gambling tax rates:

Table with the Top 10 Countries With The Highest Gambling Taxes

France currently holds the distinction of the world's most aggressive gambling tax regime. Their recent reform shifted taxation from overall turnover to GGR, meaning casinos pay tax only on their actual profits, not on stakes returned as player winnings. For 2020, brick-and-mortar casinos in France face an 83.5% GGR tax, while online betting, poker, and horse racing are taxed at 52.2%, 40.8%, and 37.7% respectively.

Denmark has set its highest rate at 75% of GGR, but this applies only to casinos whose GGR exceeds DKK 4 million (around $612,000). Those below that threshold pay a reduced rate of 45%.

Australia's gambling tax structure is determined at the state level, with lottery winnings taxed as much as 65%. Taxes for poker machines fall to about 25%, while racing and table games are generally taxed under 20%.

In the United States, gambling tax policy is divided by state, leading to dramatic variations. In Rhode Island, the rate is 51% for land-based casinos, dropping to as low as 10% in states like Colorado and Washington DC. Pennsylvania sits at 34%, while states including Illinois and New Jersey maintain rates in the low-to-mid teens. Notably, U.S. tax responsibility typically falls on players for their winnings, especially for online gambling.

The United Kingdom employs a banded system, beginning at 15% on the first £2,370,500 of income, then escalating incrementally to 20%, 30%, 40%, and ultimately 50% for the largest revenues.

Beyond these leaders, other European markets such as Portugal and the Netherlands also feature substantial GGR taxes. Portuguese casinos and online poker sites pay between 15% and 30%, while in the Netherlands, a 29% GGR tax is accompanied by an added 2% fee.

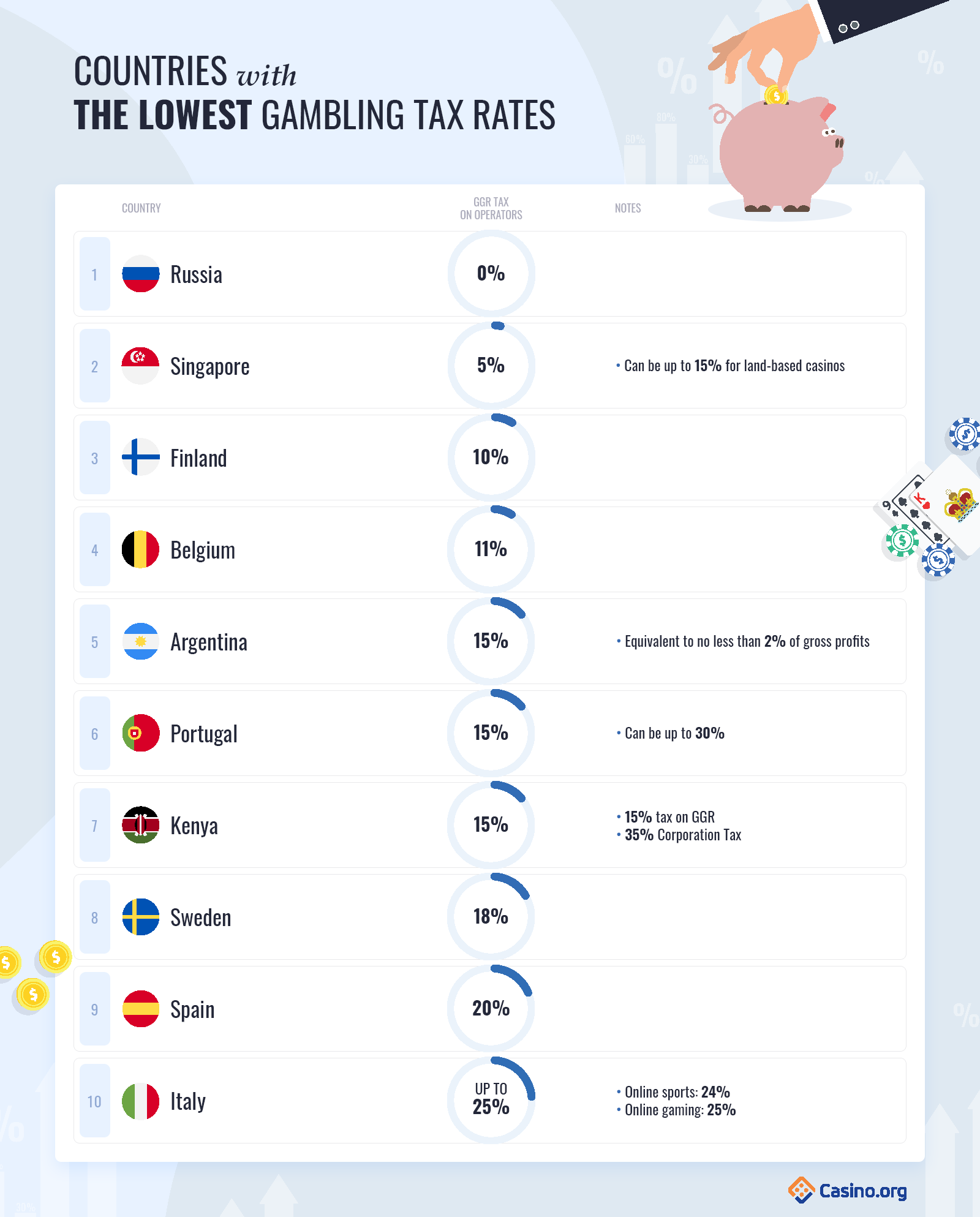

Countries with the Lightest Gambling Tax Burdens

While many governments impose heavy taxes, some countries-a select few-offer almost tax-free environments for gambling operators:

Table with the Top 10 Countries With The Lowest Gambling Taxes

Russia tops the list for casino operators looking for tax relief. Instead of taxing gaming revenue, Russian law requires only a fixed fee per gaming table or slot machine-meaning GGR is effectively untaxed. This lack of direct gaming revenue tax makes Russia unique in its approach.

Singapore maintains a low 5% tax for most gambling activities, though this rate increases to 15% for specific land-based casino revenues.

Kenya briefly instituted a 20% tax on sports betting turnover, prompting the key betting operator SportPesa to exit the market. However, after national debate, this high turnover tax was scrapped as of June 2020.

Argentina, known for tax-free gambling winnings historically, has recently proposed imposing a 15% gross income tax supplemented by a 2% administration fee.

Italy has recently focused on taxing online gambling with a 25% GGR rate for internet-based operators.

In Sweden, since 2019, a unified gambling tax set at 18% of GGR was implemented to foster a player-centric market. This tax applies to all licensed sports betting and online gambling providers.

The Pandemic’s Influence: How COVID-19 Affects Gambling Taxation

The gambling industry infuses billions into economies through taxation, but the ongoing global pandemic has significantly disrupted this revenue stream. Casino closures and decreased tourism have led governments to reassess their approaches to gambling taxation as they try to fill budget deficits.

The United States

In 2019, U.S. commercial casinos generated a record $43.6 billion in GGR, resulting in $10.2 billion flowing into state and local government coffers. The 2020 pandemic, however, severely affected casino revenues-Maryland alone lost $372.5 million in GGR over three months, reducing their education fund by nearly $149 million. To support recovery, Atlantic City enacted temporary relief measures, suspending hotel occupancy and parking taxes for casinos until the end of 2020 to stimulate the local economy and revive tourism.

Macau

Asia's largest gaming hub endured an unprecedented 97% plunge in gaming revenues in April 2020 due to tough travel restrictions. Despite the dramatic downturn, Macau's government has opted not to cut gambling taxes, relying on these revenues as a major source of public funds.

Singapore

Conversely, Singapore opted to support its domestic casino industry by providing a temporary 10% tax break to its two integrated resorts and a substantial 30% reduction on hotel-related taxes to ease the financial burden resulting from the pandemic's impact.

Japan

In Japan, plans for launching major casino resorts continue, with leaders viewing legalized gambling as a tool to jump-start the economy following pandemic-related setbacks.

Conclusion: Navigating a Shifting Tax Landscape

Global gambling tax policies reflect a complex blend of economic goals, regulatory preferences, and social priorities. While some countries leverage high tax rates as a major revenue source, others cultivate low-tax environments to attract operators and boost associated industries. The COVID-19 crisis has brought additional uncertainty, prompting some jurisdictions to ease tax rates temporarily, while others depend ever more heavily on gambling revenues to balance budgets. As regulatory environments shift, staying informed on the latest tax requirements remains crucial for casino operators and players worldwide.

Sources:

https://www.pc.gov.au/inquiries/completed/ageing/technicalpapers/technicalpaper10.pdf

https://www.finsmes.com/2019/10/the-gambling-industrys-effect-on-the-uk-economy.html

https://www.yogonet.com/international/noticias/2018/12/05/48455-buenos-aires-province-regulates-online-gambling-and-sets-new-tax-on-slots

https://iclg.com/practice-areas/gambling-laws-and-regulations/austria

https://uk.practicallaw.thomsonreuters.com/4-636-9099?contextData=(sc.Default)&transitionType=Default&firstPage=true&bhcp=1

https://www.edisongroup.com/wp-content/uploads/2019/07/GamingSectorReport2019.pdf

https://www.forbes.com/sites/muhammadcohen/2019/04/09/singapore-makes-casinos-an-offer-they-cant-refuse/