Understanding Money Laundering: How It Operates and Its Impact on the Gambling Sector

Money Laundering Explained: Transforming Illicit Funds into Seemingly Legitimate Assets

Money laundering is a sophisticated method that criminals use to disguise the origins of illegally acquired funds, making them appear as though they come from lawful sources. The core objective is to "clean" money obtained through criminal activities so it can be spent or invested without raising red flags.

The term "money laundering" was popularized because criminals, including infamous figures like Al Capone, allegedly leveraged legitimate businesses-such as laundromats-to conceal their illegal earnings.

Today, the concept encompasses a broad spectrum of tactics, all aimed at obscuring the true origins of money. The United Nations estimates that as much as $2 trillion, representing between two to five percent of global GDP, is laundered each year. This figure, while staggering, remains approximate, as the covert nature of this crime makes accurate measurement virtually impossible.

The Money Laundering Process: Stages from Illicit Cash to Legal Assets

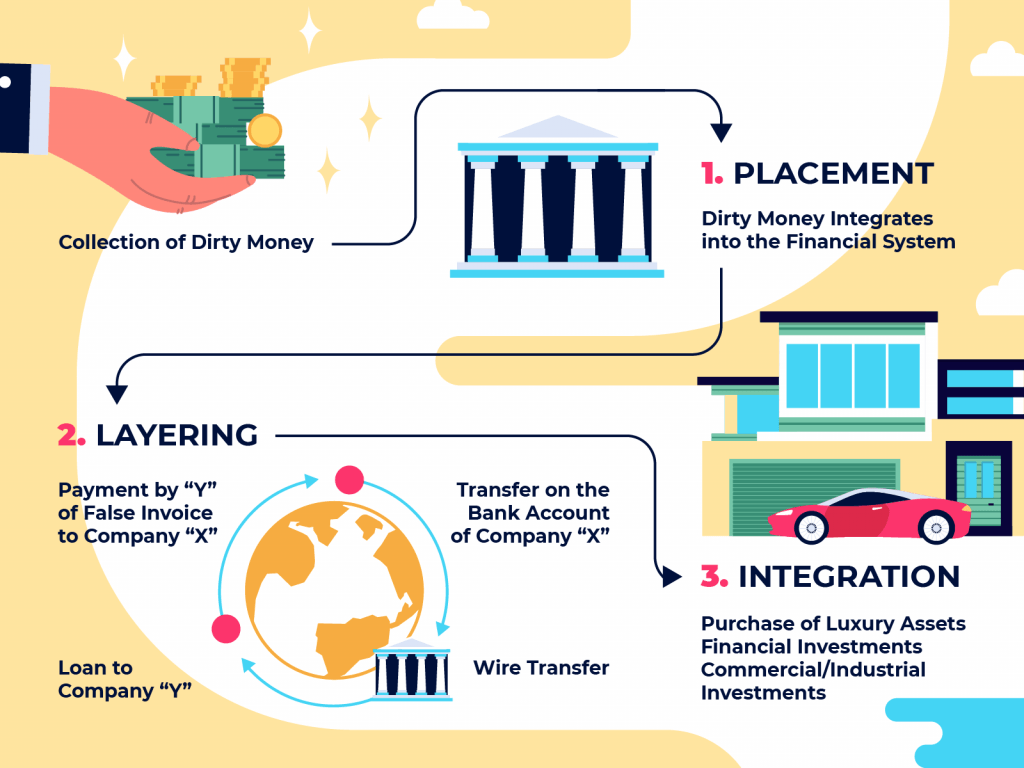

Money laundering generally unfolds in three fundamental phases: placement, layering, and integration. Despite advancements in law enforcement and technology, these core steps remain central to the practice.

- Placement: This initial phase involves introducing illicit funds into the legitimate financial system. Criminals may deposit large sums into bank accounts, use businesses as fronts, or rely on intermediaries. This is often the riskiest stage, as sudden deposits without clear origins can attract scrutiny.

- Layering: Successive financial transactions are then used to separate the money from its illegal source. These can include wire transfers between various accounts, currency exchanges, or purchases of valuable assets like automobiles or property. The goal is to create a complex trail that is challenging for investigators to follow.

- Integration: In the final stage, the laundered funds are reintroduced as legitimate assets. This might take the form of business revenues, salaries, or legitimate company investments, making the money difficult to distinguish from legally-earned income.

Gambling’s Role in Facilitating Money Laundering

Casinos-both physical and online-have long drawn attention as vehicles for money laundering, primarily because of the high volume and fluidity of transactions within the gaming sector. In a traditional casino, a money launderer might exchange illicit cash for chips, place minimal bets, and then cash out, receiving a check or receipt that appears legitimate. Fixed-odds betting terminals and similar devices have also been exploited in this way.

Online gambling has amplified the challenge. Massive sums move through digital sportsbooks and online casinos daily, enabling criminals to deposit unlawfully sourced funds, place a few inconspicuous bets, and then withdraw the remainder in an apparently legal transaction. Criminals sometimes manage multiple accounts to keep transactions below thresholds that might trigger reports or investigations.

Unlicensed or loosely regulated online gambling platforms further complicate matters. These sites may offer minimal oversight, making it easier for launderers to exploit gaps in the system. Even reputable and licensed gambling operators acknowledge the difficulty of identifying suspicious behavior, particularly when spread across numerous small transactions.

The global online gambling market is projected to exceed $92.9 billion by 2023. With such high stakes, the ongoing fight against money laundering remains a top priority for operators and regulators alike. Effective countermeasures require staff vigilance, regular policy reviews, and ongoing training to recognize warning signs and safeguard both the business and its customers from criminal activity.

The Growing Threat of Cryptocurrency Laundering

The emergence of cryptocurrencies and digital banking has created new avenues for laundering illicit funds. Digital assets offer enhanced anonymity and can be rapidly transferred across borders, making it easier for criminals to mask the movement of illegal money.

According to a 2021 Crypto.com report, global cryptocurrency users swelled to 221 million-a figure that underscores the widespread adoption of these financial tools. Because many cryptocurrencies allow peer-to-peer transactions without intermediaries, tracing funds can be extremely difficult.

A Basel Institute on Governance report estimated that out of $21.4 billion in global crypto transactions for 2019, about $450 million were linked to criminal activity. This figure likely underrepresents the reality, given the inherent difficulty of monitoring blockchain activity and the prevalence of privacy-enhancing crypto assets.

As the popularity of cryptocurrencies continues to grow, tackling crypto-based money laundering is expected to become an increasingly high priority for enforcement agencies and governments worldwide.

Conclusion: Addressing the Ongoing Challenge of Money Laundering

Money laundering remains a significant and evolving threat, particularly within the gambling sector and digital currency landscape. While authorities and businesses are stepping up efforts to detect and deter this form of crime, criminals continue to adapt with increasingly sophisticated methods.

Advancing technology, intensive staff training, and robust regulatory frameworks will be essential in closing loopholes and ensuring that gambling-and the broader financial system-remains free from criminal exploitation.

This article is intended for informational purposes only and is not a substitute for legal guidance. Its aim is to enhance awareness of money laundering risks and promote proactive prevention measures.