Understanding Financial Hangovers in the US and Canada: How Nightlife Spending Lingers

After a lively evening out, the pain doesn’t always end with a headache the next morning—the anxiety of reviewing your bank account, often called a “financial hangover,” can last much longer. To explore just how widespread and impactful this phenomenon is, a comprehensive survey gathered insights from 3,000 Americans and 3,000 Canadians about their experiences with post-night-out spending regrets and related stress.

Main Insights from the North American Financial Hangover Survey

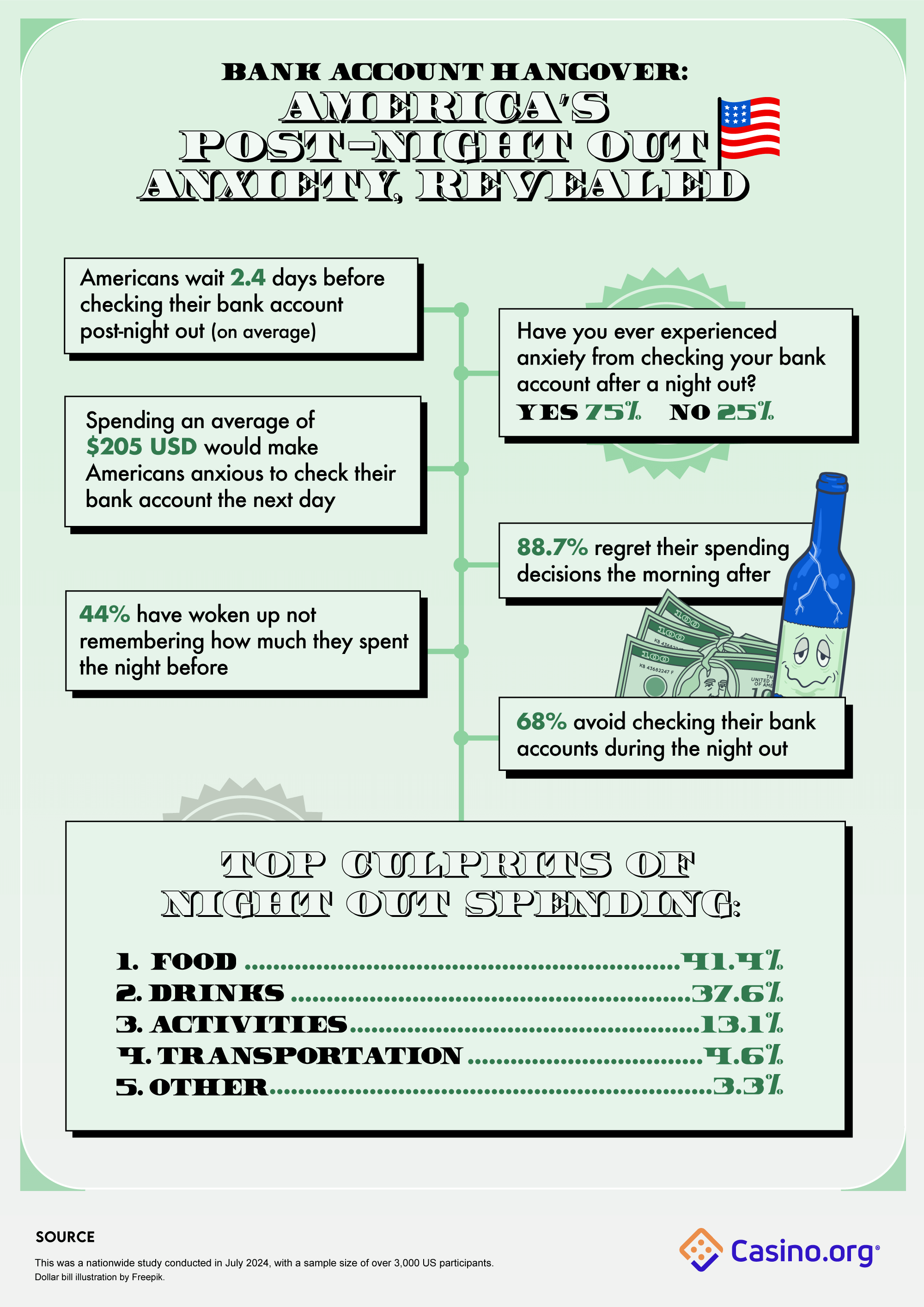

The survey revealed some striking trends affecting nightlife enthusiasts across both countries:

– Nearly 75% of Americans and Canadians feel anxious when checking their bank accounts after a night out.

– An overwhelming 88% experience regret over their spending by the following morning.

– Americans typically put off checking their accounts for 2.4 days, while Canadians delay even longer, averaging 2.8 days.

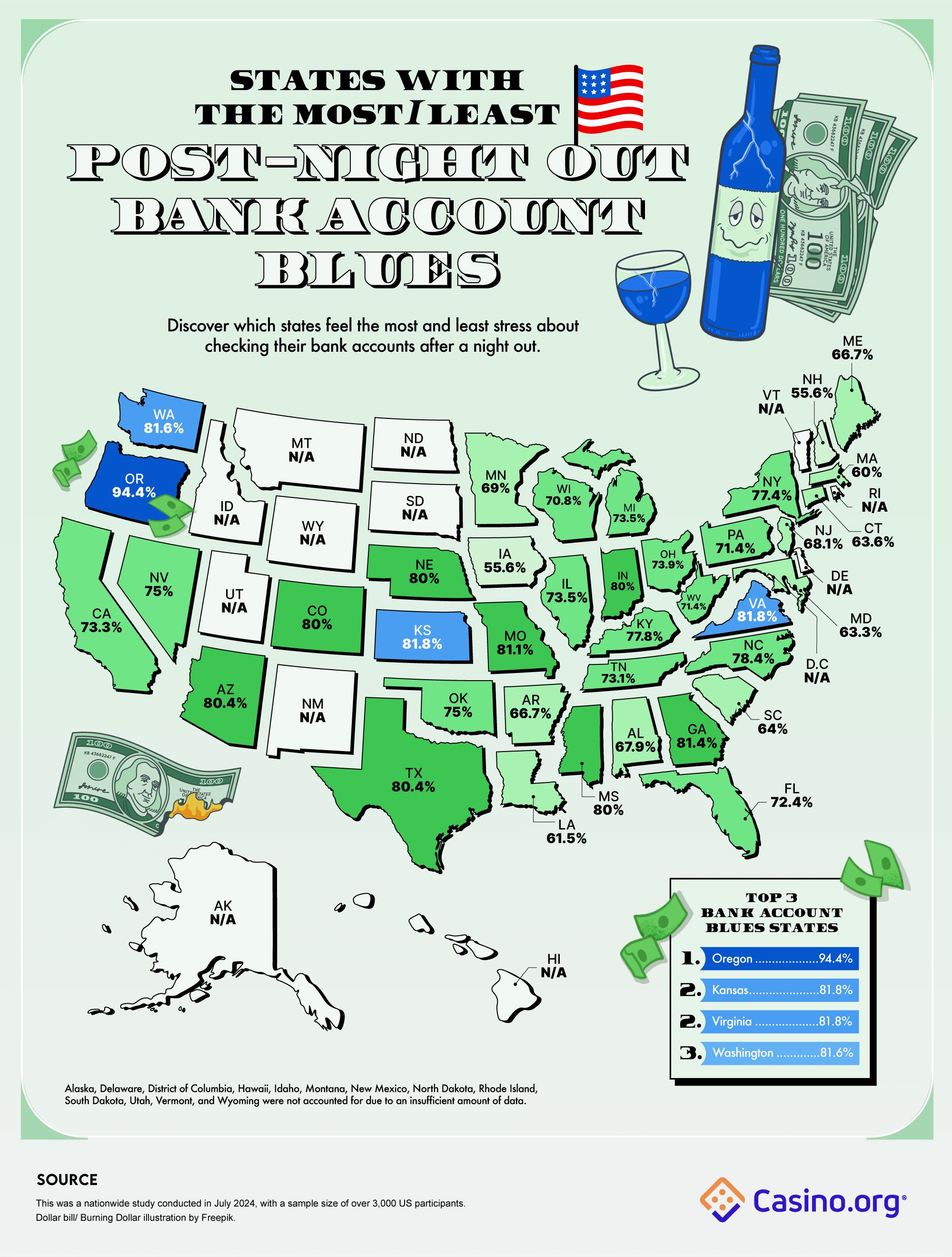

– In the US, Oregon leads the states for financial hangover rates, with 94.4% of residents experiencing this anxiety.

– Newfoundland and Labrador rank highest in Canada for financial hangovers, affecting 84% of locals.

The Prevalence of Financial Hangovers in the United States

Most Americans (three out of four) report feeling apprehensive about reviewing their transactions the morning after a night out. Over half of surveyed Americans commonly experience a financial hangover, and many delay confronting their spending, with the average wait being 2.4 days.

A substantial 88.7% acknowledged regretting their post-night-out purchases the next day, while 44% admitted to not remembering exactly how much they spent. On average, respondents felt discomfort when they noticed an expenditure of about $250 from just one night out.

Although about half set a spending budget for their nightlife activities, 35% struggle to stay within it. Furthermore, 68% actively avoid checking their balances during a night out to stave off anxiety.

When it comes to where the money goes, food claims the top spot, accounting for 41.4% of spending, followed by drinks, group activities, and transportation (at 4.6%). A small portion of participants fell into the “other” category, unable to recall their spending due to the blur of the evening.

States with the Highest Rates of Financial Hangovers

Oregon stands out as the state with the highest rate of financial hangovers. Nearly 94.4% of respondents from Oregon reported experiencing anxiety about their bank accounts post-night out. Most residents in Oregon feel compelled to check their balances within a day, with over half unable to remember their spending, and $104.20 representing the threshold for discomfort. Food and drinks are equally responsible for their spending regrets.

Kansas and Virginia share second place, with 81.8% of residents reporting similar anxieties. Kansans wait an average of 1.7 days before reviewing their expenditures, while Virginians hold off for about 3.3 days. Despite the difference in delay, regret is high in both states—88.9% in Kansas and 87.9% in Virginia. Spending just $109.54 in Kansas or $255.67 in Virginia leads to significant anxiety.

Washington follows closely behind with 81.6% of residents experiencing financial hangovers and a tendency to delay account checks by about 2.2 days.

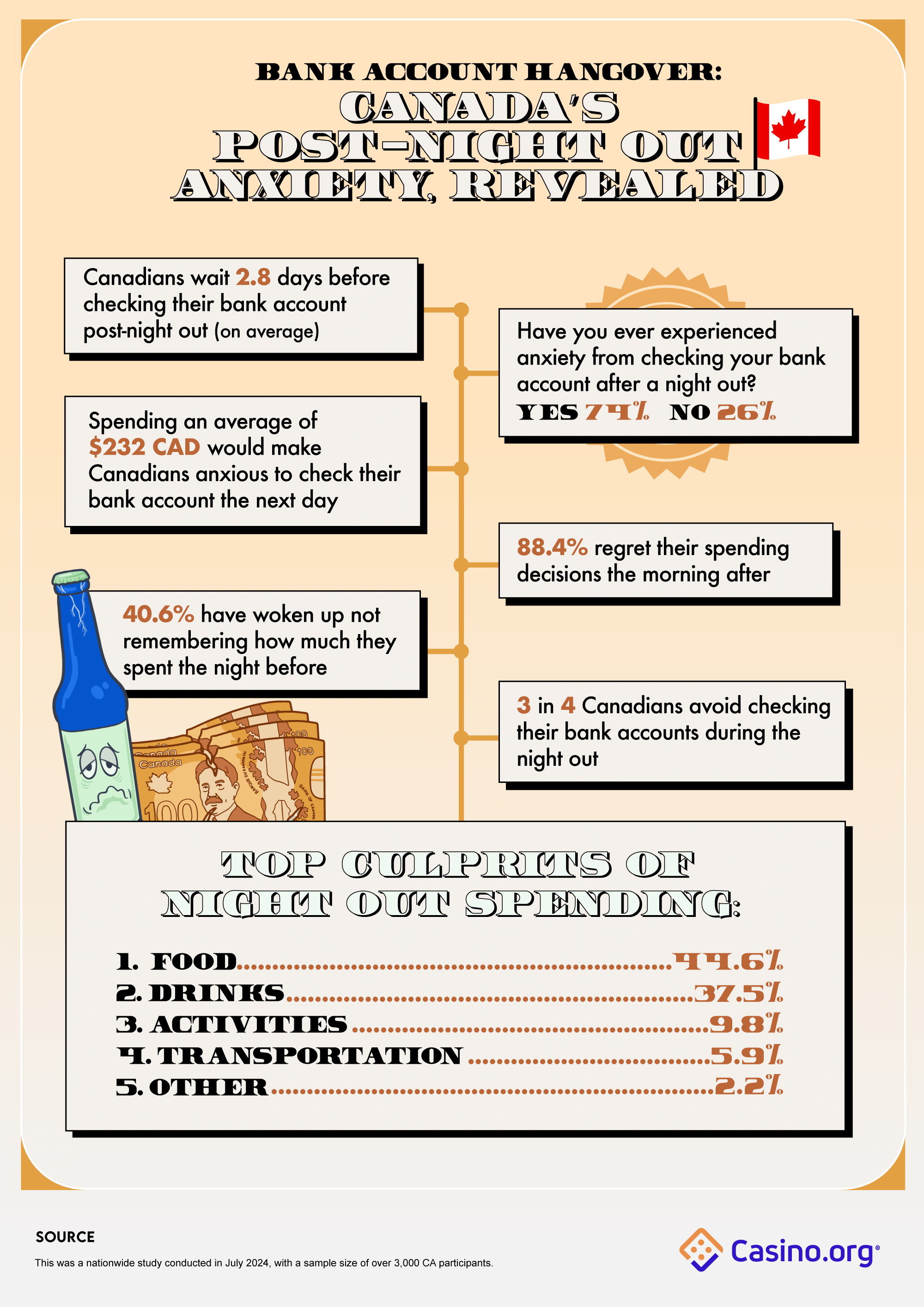

Canadian Perspectives: Post-Night Out Spending Regrets

In Canada, about 74% of survey participants experience anxiety about their finances after a night out. While half deal with these feelings on occasion, a significant 15% report struggling with financial hangovers after every night out.

Canadians are particularly prone to procrastination, with an average delay of 2.8 days before reviewing their bank accounts. Nearly nine in ten respondents regret their spending decisions the next day, and 60% have no recollection of how much they spent.

For Canadians, spending about $232 CAD in a single night is enough to cause financial stress. Interestingly, compared to Americans, fewer Canadians set nightlife budgets—54.6% reported not budgeting at all. Almost three-quarters avoid checking their transactions during the night.

As for expenses, food leads again at 44.6%, followed by drinks (37.5%), activities, and then transportation. Those in the “other” category cite memory lapses thanks to the night’s festivities.

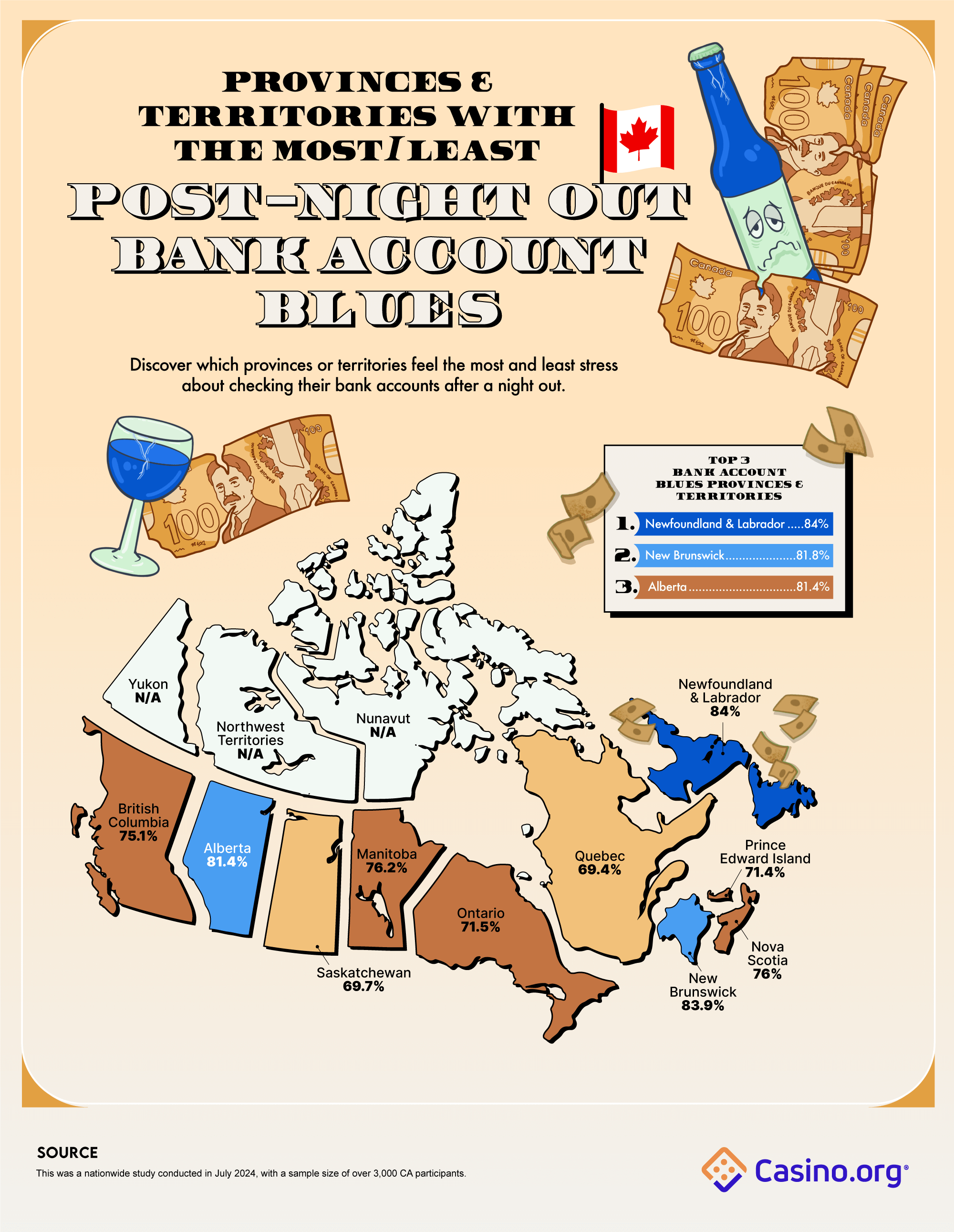

Financial Hangover Rankings Among Canadian Provinces and Territories

Newfoundland and Labrador top the list for financial hangover prevalence in Canada, with 84% of locals admitting to post-night-out spending anxiety. Residents here wait an average of four days before checking their accounts, and 89% experience regret. The average amount spent before discomfort sets in is $246. Notably, drinks (48%) are the most significant expenditure in this province.

New Brunswick lands in second place with 83.9% affected. Every respondent from New Brunswick reported regretting their spending decisions, and like those in Newfoundland and Labrador, they tend to wait four days before facing their financial reality. Spending $186.77 per night is enough to worry most locals, and food represents 42% of their total expense.

Alberta claims third place, with 81.4% of residents experiencing financial hangovers and waiting an average of 2.8 days before checking their balances. Nightlife expenditures average $233.08, with 45% blaming food as the primary culprit.

Las Vegas: Financial Hangovers Under the Neon Lights

The appeal of Las Vegas nightlife is strong, but so too are the regretful mornings that follow. Among the 48% of Americans who have visited Las Vegas, 35% returned home only to discover a financial hangover from the excitement of the casinos and nightlife. Similarly, one-third of Canadian visitors to the Las Vegas Strip also faced unwelcome surprises in their post-trip bank statements.

Conclusions: What You Spend at Night Follows You Home

The data suggests that the aftermath of a spirited night out extends beyond physical discomfort. Three-quarters of Americans and Canadians encounter anxiety when checking their bank balances following a night of revelry. The next time you’re tempted to order one more round, consider whether your future self will appreciate the splurge.

Survey Methodology

This study was conducted via an online survey in July 2024. Responses were obtained from 3,000 Americans and 3,000 Canadians regarding their post-night-out financial behaviors and regrets.

– The US sample had an average age of 36.6 years, with respondents identifying as 60% female, 37.4% male, 1.7% non-binary, and 0.8% transgender.

– The Canadian sample averaged 33.8 years old, comprising 52.5% female, 44.9% male, 2.4% non-binary, and 0.2% transgender.

– US data exclude Alaska, Delaware, D.C., Hawaii, Idaho, Montana, New Mexico, North Dakota, Rhode Island, South Dakota, Utah, Vermont, and Wyoming due to insufficient sample sizes.

– Canadian data omit Northwest Territories, Nunavut, and Yukon for the same reason.

Usage Rights

You are welcome to use and share the information or graphics from this article for non-commercial purposes. Please credit the source with proper attribution and a link back to this page. For press inquiries, contact the authors directly.